Did you know the rules have changed and you can instruct barristers on behalf of your clients (or yourself)

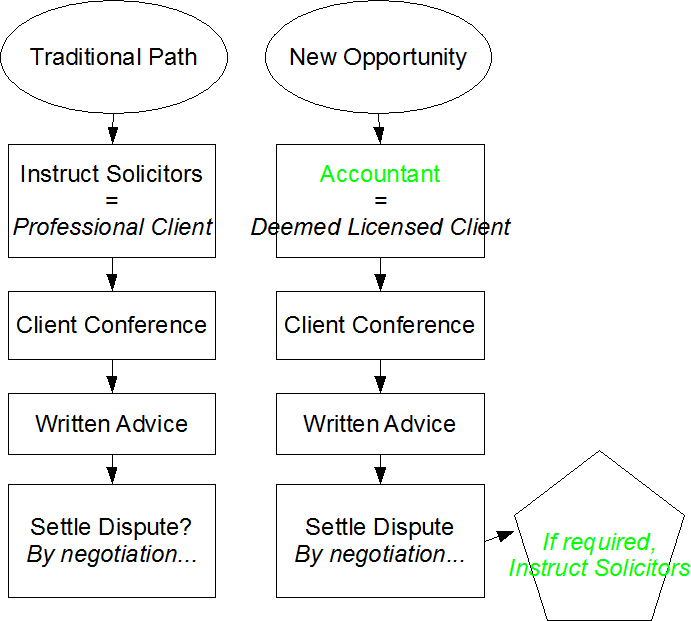

Flow Chart: Solicitors instructing Barristers v Accountants instructing Barristers

The Legal Landscape is Changing

The legal landscape is changing; in particular how solicitors and barristers work with each other. The emphasis is on opening up access to the expertise of barristers to a limited number of professions – previously, the exclusive domain of solicitors. As accountants, you can now add value to your mainstream services by instructing barristers on legal matters on behalf of your clients avoiding incurring solicitor fees and charging for your assistance.

Anybody can apply to have a Licence for the purposes of instructing barristers. Accountants have the benefit of a licence by default[1] (a deemed licence).

The Rules

Pursuant to changes to the Code of Conduct applicable to barristers, in particular r.401(a)(iii) and the Licensed Access Rules, accountants (along with a limited number of other esteemed professions) may instruct barristers on behalf of their clients under the Licensed Access Scheme.

Advantages

Looking at the flow chart above, you will see that the restrictions are a limited obstacle in resolving most legal disputes, which are settled outside of the court. This early intervention:

- Saves money on legal fees;

- Saves time, which can be better invested in the client’s own business;

- Avoids the risk of litigation, in particular, the costs of the other side and

- Saves goodwill between business partners.

As accountants, you are in a unique position to assist lay clients. You have an intimate knowledge of the client’s business and receive early notice of brewing legal disputes. An early intervention often means settlement by agreement is all the more likely between disputing parties and critically saving goodwill between business partners. This allows you to add value; earn goodwill; and charge for your assistance.

How to Instruct a Barrister under the Licensed Access Scheme?

- Contact the barrister or his chambers and book a conference

– Assist the client in bringing together the paper work that may be relevant to the issue in dispute, e.g. if there is a dispute within a partnership, the partnership agreement. - Attend a conference with the barrister (cost, circa £300 – £500)

– Only the lay client has to attend. - Receive written advice (cost, circa £500 – £2,000)

– The advice will cover agreed issues, e.g. chances of success or next steps. - Attempt to settle matters by negotiation

– The client or you can then conduct negotiations with a handle of the strengths and weaknesses of the client’s legal position.

What happens if matters do not settle through negotiation / mediation etc.

Consideration will need to be given as to whether court proceedings should be issued.

Note

At all times, it is incumbent on the barrister to keep under review whether it is in the interests of the lay client to be represented by a solicitor and advise accordingly.

Ordinarily, barristers cannot conduct correspondence, e.g. letters to the other side negotiating. However, we can provide advice on carrying out correspondence or e.g. draft letters.

This general restriction provides further scope for you to assist the lay client beyond the initial instructions and charge for your assistance.

Full List of Licensed Clients Deemed to be Authorised

Part I – Accountants and taxation advisers

1. The Association of Authorised Public Accountants

2. Association of Taxation Technicians

3. The Association of Chartered Certified Accountants

4. The Chartered Institute of Management Accountants

5. Institute of Chartered Accountants

6. The Institute of Chartered Accountants in Ireland

7. Institute of Chartered Accountants in Scotland

8. The Chartered Institute of Taxation

9. The Institute of Financial Accountants

10. The Institute of Indirect Taxation

Part II – Insolvency practitioners

1. Insolvency Practitioners Association

Part III – Architects surveyors and town planners

2. The Architects Registration Council of the UK

3. The Architects and Surveyors Institute

4. Association of Consultant Architects

5. The Royal Institute of British Architects

6. The Royal Institution of Chartered Surveyors

7. The Royal Town Planning Institute

Part IV – Engineers

1. The Institution of Chemical Engineers

2. The Institution of Civil Engineering Surveyors

3. The Institution of Civil Engineers

4. The Institution of Engineering and Technology

5. Institution of Mechanical Engineers

6. The Institution of Structural Engineers

Part V – Valuers

1. The Incorporated Society of valuers & Auctioneers

Part VI – Actuaries

2. The Faculty of Actuaries

3. Institute of Actuaries

Part VII – Chartered secretaries and administrators

1. The Institute of Chartered Secretaries and Administrators

Part VIII – Insurers

2. The Association of Average adjusters

3. The Chartered Institute of Loss Adjusters

4. The Chartered Insurance Institute

If any readers have questions on this article, they will be happily received @ taj.uddin@gcp-barristers.com.

Taj Uddin, MA Oxon

Barrister, Guildhall Chambers Portsmouth

Practising in London and the South (Salisbury to Brighton, Oxford to IoW)

[1] Para 7, Annex3 F1 – Licensed Access and Recognition, The Code of Conduct, Bar Standards Board